Chartered Accountancy as a career option

CA or Chartered Accountancy is a prestigious course, and Chartered Accountancy as a career option is guiding the accounting professionals across the world, except for the United States. The equivalent of CA in the US is the CPA or certified public accountant. Through this course, you will learn subjects such as tax laws, taxation, corporate law, business laws, and auditing.

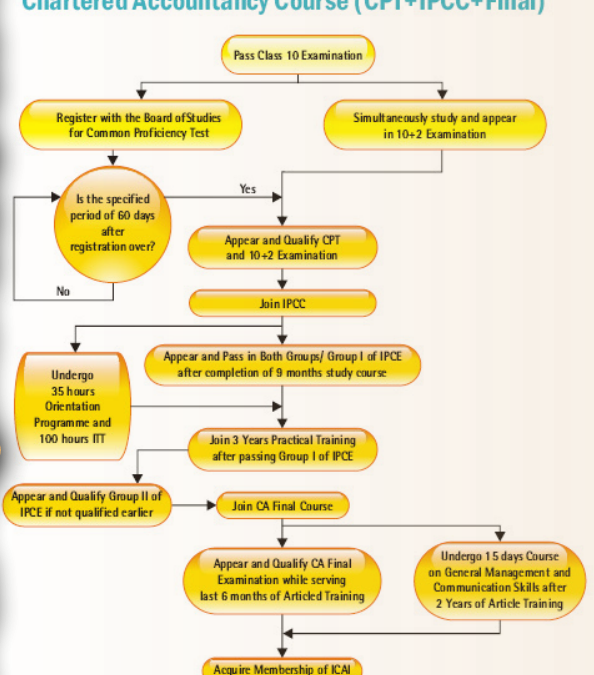

CA course is divided into three levels, i.e.:

- CPT (Common Proficiency Test)

- IPCC (Integrated Professional Competence Course)

- FC (Final course)

Students need to clear a previous level to take up the next exam. CA is one of the most sought-after career options after 12th for commerce students. The overall difficulty of this course is very high and therefore it might take some students multiple attempts to clear a level. You should check out the maximum number of attempts before pursuing the course so that you can prepare better. It is among the most paid career choice in the field of commerce.

Some of the subjects you would master while pursuing CA course are:

- Accounting

- Cost Accounting and Financial Management

- Information Technology

- Taxation

- Auditing and Assurance

- Ethics and Communication

- Corporate and other Laws

- Business Laws, and others

You can get all information regarding this course on the ICAI website.

Eligibility: 10+2 with a minimum 60% aggregate

Chartered Accountancy: Course Highlights

| Name of the Course | Chartered Accountancy |

|---|---|

| Course Level | Undergraduate |

| Course Duration | 3 years – 4 years |

| Eligibility | 10+2 with a minimum 60% aggregate |

| Average Salary | INR 7 lakhs |

| Job Profiles | Internal Auditing, Forensic Auditing, Career in Accounting and Finance, Tax Auditing, Statutory Audit under applicable statutes, Managing Treasury function, Forensic Auditing, |

CA (Chartered Accountant) course:

CA is a professional course and it is administered by a professional body “Institute of Chartered Accountants of India”. This is the most popular course among the students of commerce stream. This is a professional course and opens various opportunities for the students, starting from self-employment or self-practice as an independent CA or employment in major Indian and multinational companies, local and foreign banks and audit firms.

What is Chartered Accountancy and what are the career opportunities?

The Chartered Accountant Course contains the following modules:

Chartered Accountant Course Module no. 1 – Common Proficiency Test:

This test contains vital subjects such as:

Accounts

Economics

Statistics

Mercantile Law

Chartered Accountant Course Module no. 2 – Integrated Professional Competence Course

This course covers a variety of subjects in two different parts:

Part 1 contains:

Accounts

Law

Taxation

Costing and Financial Management

Part 2 contains:

Auditing and Assurance

Advanced Accounting

Information Technology

Strategic Management

Chartered Accountant Course Module no. 3 – Articleship/ Training

In this module, the students doing the CA course have to take an internship under a practicing Chartered Accountant to learn the practical aspects related to the Chartered Accountant as a profession during this training.

Chartered Accountant Course Module no. 4 – CA Final Exam

There are 8 subjects in Chartered Accountant final exam which are divided into two groups:

CA Final Exam (Group 1)

Financial Reporting

Advanced Auditing and Professional Ethics

Strategic Financial Management

Corporate Law and Allied Laws

CA Final Exam (Group 2)

Advanced Management Accounting

Direct Tax Laws

Information Systems Control and Audit

Indirect Tax Laws

#CA #india #career #careerinCA #getCAdegree #applyforCA #guidanceforCA

Recent Comments